Read On To Learn More Details About Bad Credits Lending

Article written by-Pontoppidan Hove

If you have inadequate credit score, then you need to consider acquiring a negative credit scores Lending. You can get this type of Finance from a bank, credit union, or a banks that offers such items. You must also look into the BBB rating of the lending institution before using. Some loan providers will certainly bill origination costs that should be examined prior to requesting a finance. When obtaining a negative credit score Funding, make certain to ask inquiries concerning the fees.

When selecting a loan provider for a poor credit report Finance, try to find a firm that reports repayments to the significant credit scores bureaus. If your lending institution does not report repayments to these bureaus, it is best to look for a various lender. This will ensure that you pay in a timely manner and also will not be negatively reported if you miss a settlement. While a poor debt Funding will certainly cost you even more money in the long run, it can help you boost your credit rating.

A bad credit score Loan is a short-term economic service for consumers with bad credit history. These finances generally come with a high interest rate, however they can be a necessary action in getting your monetary life back on the right track. Taking out a negative credit scores Finance can help you boost your credit report and end up being a much more eye-catching loaning prospect. https://www.cnbc.com/select/how-much-money-to-put-towards-debt/ might also want to take into consideration a revolving credit line to help you get back on your feet.

If you are unable to receive a standard Lending because of your bad debt, you can try out online loan providers who specialize in such loans. You can see deals from a number of lending institutions on the site, as well as choose the one that ideal matches your demands. If you discover one that satisfies all your demands, you can begin the application procedure. You will certainly require to supply a few pieces of personal information such as your ZIP code, date of birth, and social security number. After you have actually authorized, you will certainly be able to get your money within a company day or 2. After sending your application, you will need to pay back your Funding, and also if you fail to satisfy the terms of the contract, you may find yourself in an even worse circumstance than previously.

While a bad credit history Funding can be valuable, it's best to just think about these options when it is definitely necessary. Remember, you are putting a substantial possession in jeopardy by acquiring a bad credit rating Funding. See to it you can pay it back prior to you look for one. Or else, https://www.fool.com/the-ascent/personal-loans/articles/7-steps-to-getting-a-personal-loan-with-bad-credit/ may wind up damaging your credit score. There are various other, more affordable alternatives. You can use charge card cash loan to finance your acquisition. You'll likewise be able to get money from an atm machine.

To get a bad credit histories Loan, you'll need a good credit score. Candidates with a score of less than 500 will likely get a smaller Loan than those with a greater rating. You'll likewise require a bank account, a resource of normal earnings, and a valid e-mail address. Additionally, you must be at the very least eighteen years of ages and a united state citizen. If you have inadequate credit history, you may receive a small Lending, but if your credit score is listed below these criteria, you'll require to look around.

Bad credit report lendings can be hard to obtain. However the good news is that there are numerous choices offered. Much of these financings are used online. In addition, you can investigate lenders in your state. There are reputable economic companies that use such fundings. You can likewise go online and also Google for bad credit score car loans to find the most competitive options. Then, use and also obtain a car loan. As well as, make sure to search to locate the very best bargain.

When you're in need of funds, consider applying for a poor credit report Finance. These financings are available, yet you may have to make a few compromises to receive them. Even though they come with high interest rates and also various other limitations, they'll typically enable you to obtain the cash you require in the short-term. This may be a good option if you require cash urgently, however you need to do your due persistance as well as contrast rates before making a final decision.

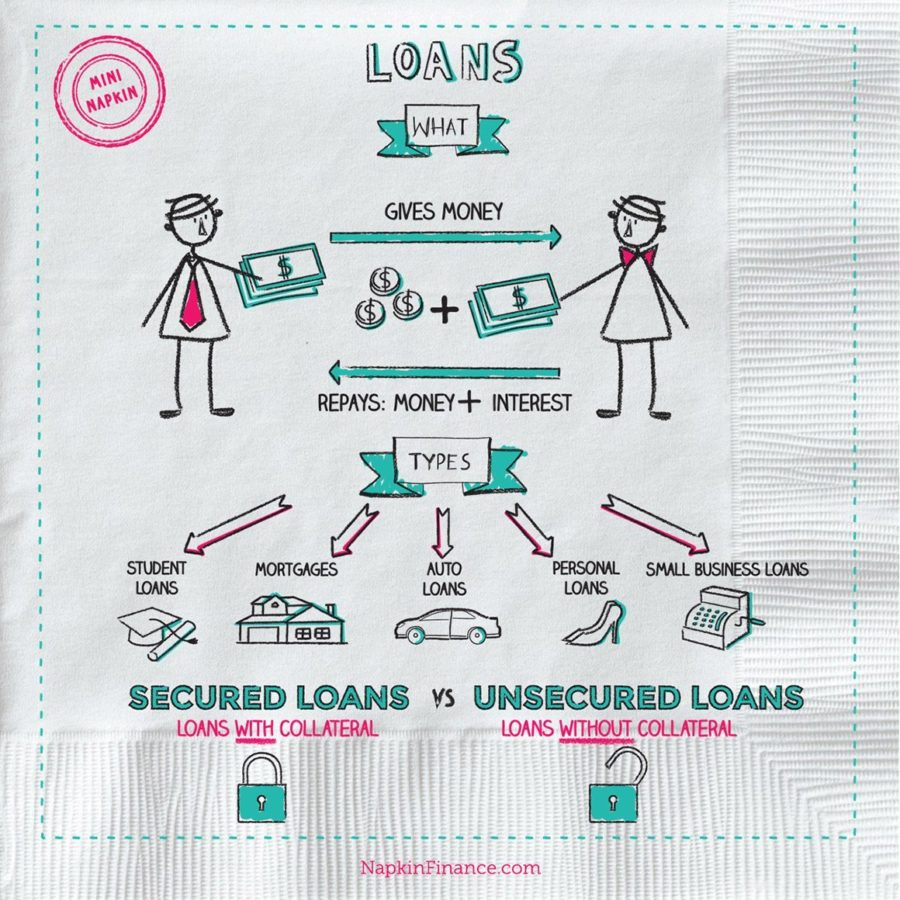

Unsecured individual car loans are not as risky as protected fundings, but they tend to have higher rates of interest and lower line of credit. In case of non-payment, lending institutions can offer your debt to a debt collector or take you to court to collect it. Once you have actually been approved, you should start to see some cash transferred right into your checking account. The moment it requires to receive the funds varies between lending institutions, however you can normally expect to get them the next day.